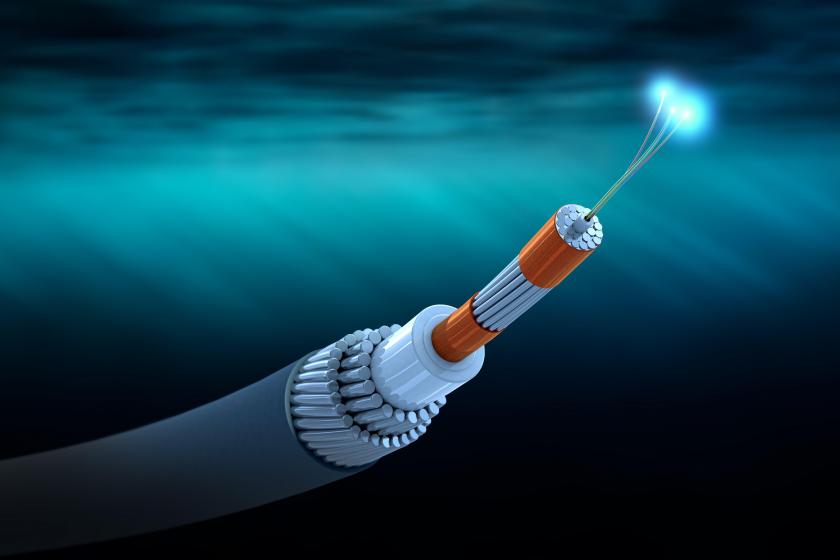

Plans for competing internets are emerging under the sea between the United States and China, according to a recent Reuters report.

Reuters says China’s state-owned telecom firms are building a $500 million fiber-optic internet cable network on the sea floor. China Telecommunications Corporation (China Telecom), China Mobile Limited, and China United Network Communications Group (China Unicom) are planning the "world's most advanced and far-reaching subsea cable networks," say four people that Reuters cited.

The cable, called Europe-Middle East-Asia (EMA), would run from Hong Kong to China’s island province of Hainan before continuing to Singapore, Pakistan, Saudi Arabia, Egypt, and France, Reuters said.

HMN Technologies would manufacture and lay down the EMA Chinese cable, according to Reuters.

An American subsea cable company SubCom is installing a $600 million cable called South East Asia–Middle East–Western Europe 6 (SeaMeWe-6), which will allow data to flow from Asia to Europe through Africa and the Middle East. The fiber cable will extend more than 12,000 miles at the bottom of the sea. It will run from Singapore to France, with completion planned for 2025.

A SubCom spokesperson declined to comment for this story.

“As technology progresses and needs grow, there's always another cable to be built that will replace some of the ones that are being decommissioned like SeaMeWe-3,” says Doug Madory, director of internet analysis for network observability company Kentik.

More than 95% of intercontinental global data traffic runs over undersea cables across the ocean floor. Madory breaks down what network managers need to think about regarding China’s submarine internet cable.

Will the China submarine cable affect U.S. network architects?

For starters, network architects may be limited in how to react to the new China cable because they can’t use configuration settings to avoid them, Madory says.

“I think it's pretty hard to do anything because this is operating at the layer-one level of the internet, and you don't have any configuration settings to avoid Chinese submarine cables,” Madory says. “There's just no way to do that.”

Also, some parts of the world may be forbidden from purchasing space on the EMA Chinese cable because it uses gear from Huawei (HWN).

"Definitely U.S. companies would be forbidden from buying capacity [on EMA], but that doesn't mean that none of their traffic ends up going over the cable," Madory says.

"I would think it stands to reason that there will be certain companies that will not buy capacity on a Chinese-made cable if it were to be built, but there are going to be plenty that do, and you won't be able to prevent your traffic from going through another company's network," Madory says. Because of this unpredictability, Madory describes the world of undersea cables as the “Wild West.”

Will network architects face multiple internets?

Some experts are predicting multiple internets led by separate world powers.

“It seems we are headed down a road where there will be a U.S.-led internet and a Chinese-led internet ecosystem,” Timothy Heath, a defense researcher at the RAND Corporation, a U.S.-based think tank, told Reuters. “The more the U.S. and Chinese disengage from each other in the information technology domain, the more difficult it becomes to carry out global commerce and basic functions.”

However, Madory believes this divide in internet networks already exists.

“We have that dichotomy now, so this will just be another manifestation of how that affects things like the flow and operation of the internet,” Madory says.

“Maybe we just wouldn’t know when we’re passing traffic over a Chinese-made submarine cable,” Madory says. He adds, “Once the traffic leaves your network and leaves your transit provider, you don’t have any guarantees over who’s handling your traffic.”

In fact, U.S. companies are one step removed from buying capacity on the Chinese cable since it is the telecoms who would be buying capacity.

“There are a lot of international telecoms that I think would be likely asked not to buy capacity on the cable,” Madory says.

Submarine fiber-optic cables bring a lot more capacity than satellites, according to Madory.

Madory notes that because consortiums buy capacity on undersea cables, individual tech companies, cable companies, and telecoms would likely not be asked to buy capacity on the cable, Madory says.

Related articles: