The Ethernet switch market is having a good year so far, and analysts say the outlook is healthy as enterprises and service providers continue to invest in network upgrades.

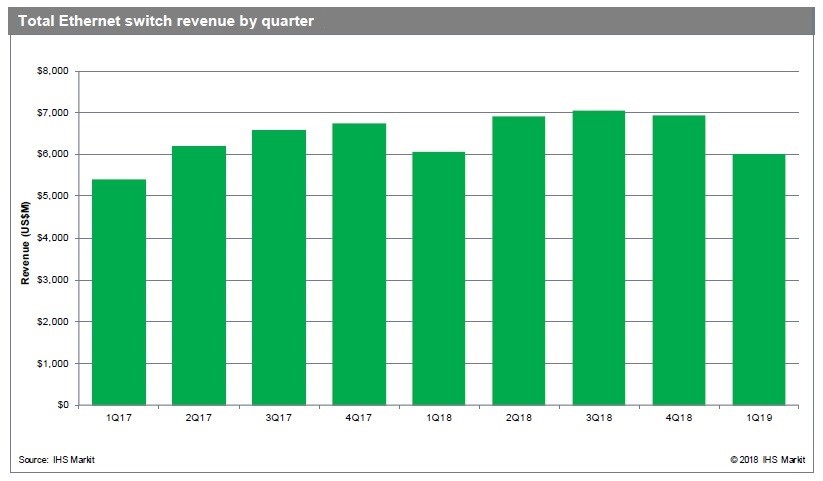

Worldwide sales of Ethernet switches totaled $6.1 billion in the first quarter of this year, a 12% increase on a year-over-year basis, according to a report released Thursday by IHS Markit. Sequentially, revenue was down 10% due to seasonal slowdown in demand, but long-term growth prospects are good, the firm said.

The momentum the Ethernet switch market gained in 2017, when it experienced the most growth in seven years since the depths of the global recession, is continuing this year, analysts said. They attributed the growth to continued data center upgrades and expansion, along with rising enterprise demand for campus networking equipment due to better economic conditions.

Ethernet switch sales for market leader Cisco grew 7% in the first quarter on a year-over-year basis, according to IHS. Sales for Huawei rose 43% while Arista Networks experienced a 40% increase year over year.

IHS Markit expects the market to continue to grow from 2019 to 2022 with a significant increases in sales of 10 Gigabit Ethernet, 25GbE, 100GbE, 200GbE, and 400GbE.

Earlier this month, IDC reported similar rosy results for the worldwide Ethernet switch market in the first quarter of 2018. Ethernet switch sales totaled $6.29 billion, an increase of 10.9% year over year, according to IDC. That first quarter growth this year is a sharp contrast to the 3.5% growth the market saw between the first quarters of 2016 and 2017, analysts said.

"After modest gains in 2017, the Ethernet switch market started 2018 with a strong first quarter," Rohit Mehra, VP of network infrastructure at IDC, said in a statement. "There are two macro trends that contributed to growth: The emergence of next-generation software-based network intelligence platforms that add to the intrinsic value of networking, and the push by large enterprises, hyperscalers, and service providers to leverage faster Ethernet switching speeds for cloud rollouts. Both trends bode well for this industry moving forward."

According to IDC, Cisco's Ethernet switch revenue in the first quarter of this year grew 7.6% year over year, but its market share of 53.4% was down slightly from its 55% share in the first quarter of 2017. Huawei's market share was 8.1%, up from 6.3% in the first quarter of 2017. Hewlett Packard Enterprise held onto the third spot with 6% market share while Arista's share grew to 6.5%, up from 5.1% in 2017.

Juniper's Ethernet switch revenue, however, fell 4.8% in the first quarter of 2018 on a year-over-year basis, reducing its market share to 3.7%, down from 4.3% in 2017, IDC reported.